Explain Different Types of Calculating Depreciation

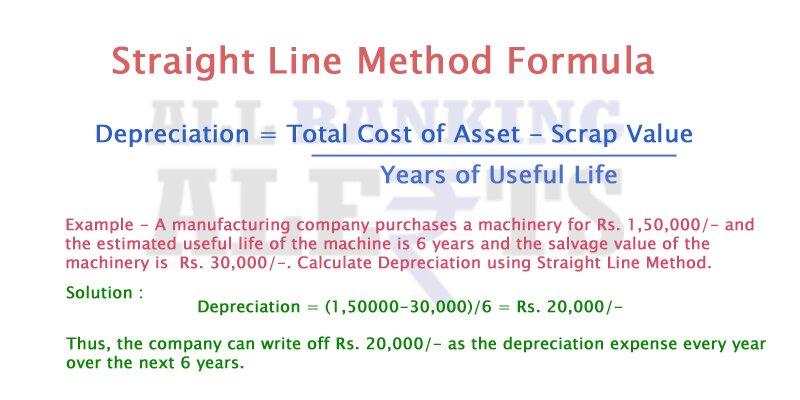

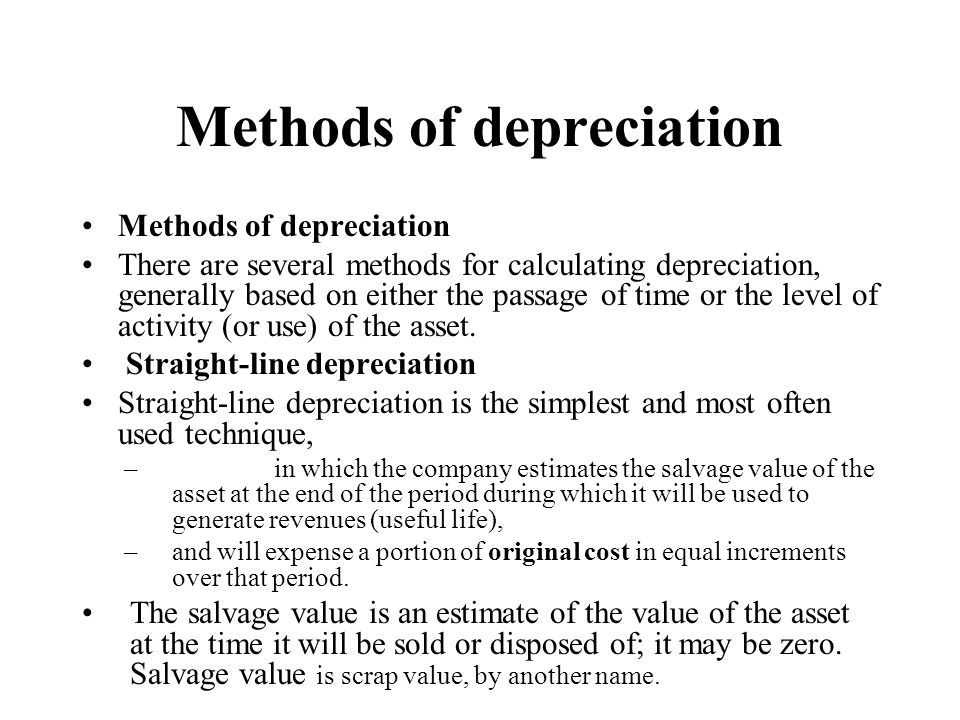

Book value Cost of the asset accumulated depreciation. The straight-line method of depreciation is the most simple and easy to use depreciation method.

Depreciation Definition Types Of Its Methods With Impact On Net Income

The written down value method also known as diminishing balance method or reducing balance.

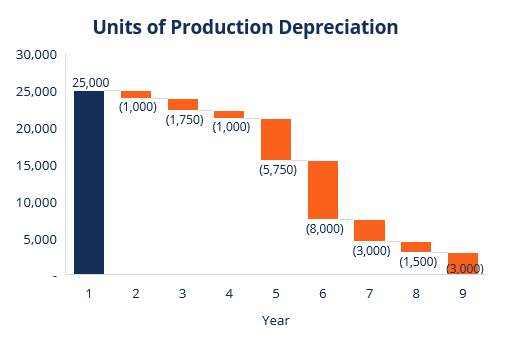

. Straight Line Or Fixed Instalment Method. Annual depreciation D Original cost Scrap value Life in year C S n. If the output in the first year is 30000 then the depreciation will be 30000 x Rs4 Rs.

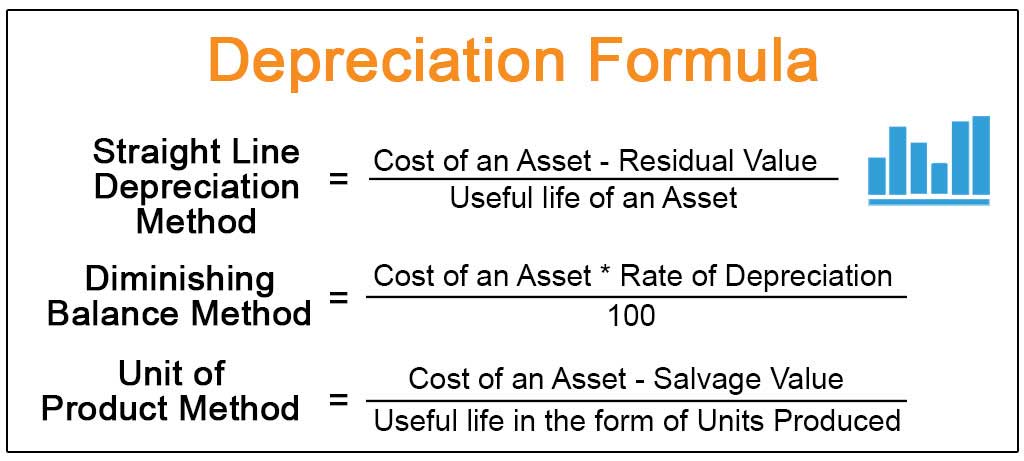

Depreciation is calculated using the following formula. Hence it is pertinent to study and make calculations for the same in a calculated manner which ensures fair and accurate presentation. Straight Line Method.

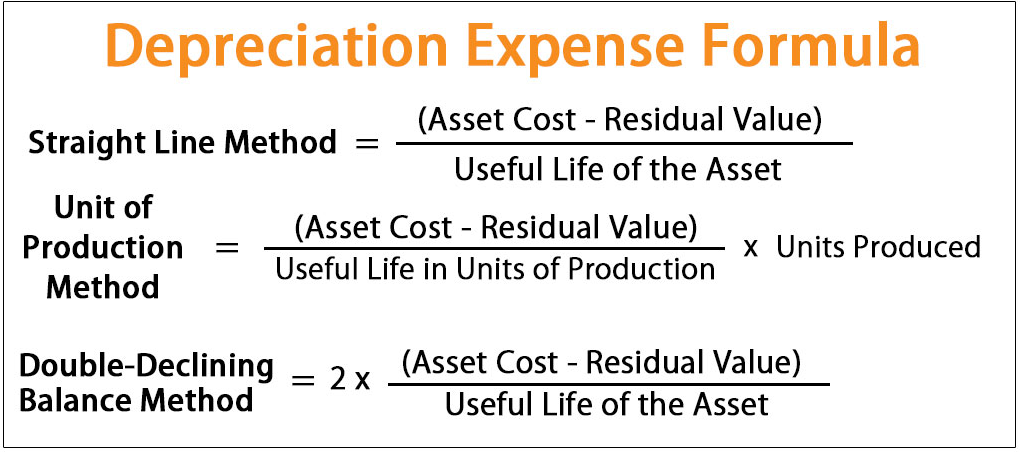

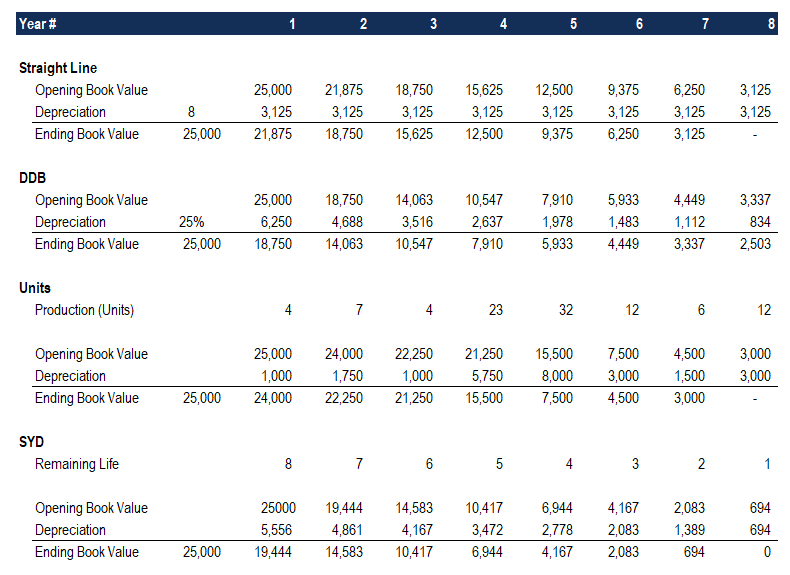

Under the sum-of-the-years depreciation method you would take the cost and subtract the salvage value and multiply it by a fraction to determine the depreciation expense. A Methods giving smaller writes-off than straight line in early years of life. The straight line method involves determining the cost to depreciate and dividing that amount by the number of years the company expects to use the asset.

The methods of depreciation include the straight-line method units-of-production method and double-declining balance. In this method depreciation. The life of the asset is estimated and.

Double Declining Balance Method. This is the oldest and simplest method of charging depreciation. I Sinking fund or present worth method ii Retirement method iii Replacement method b Methods giving.

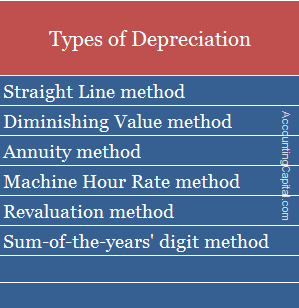

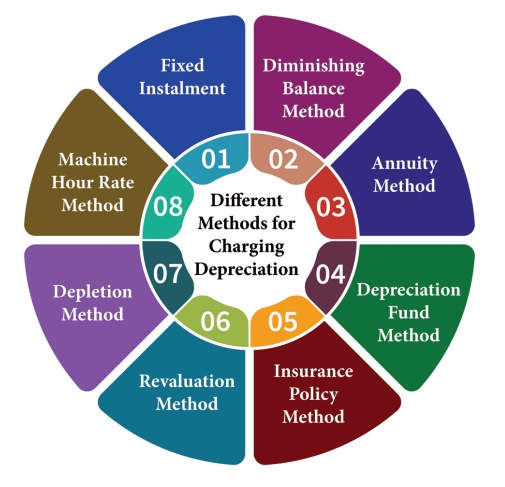

Different Methods of Charging Depreciation. Depreciation expense can be. The following are the various methods for providing depreciation.

Fixed Installment or Equal Installment or Original Cost or Straight line Method. The four main depreciation methods Straight-line depreciation method. Straight-line depreciation is the most simple and commonly used depreciation method.

Straight Line Depreciation Method. Straight Line Method SLM Under the depreciation Straight Line Method a fixed depreciation amount is charged annually during the lifetime of an. Depreciation Methods 4 Types of Depreciation Formula Calculation 1.

Straight Line Or Fixed Instalment Method. The annuity method of. The two most common methods of calculating depreciation are.

Sum of Years Digits Method. Methods of Depreciation and How to Calculate Depreciation. There are various methods of asset depreciation.

Explain different types of depreciation methods with illustrative examples. Common methods of depreciation are as follows. Written Down Value Method.

D annual depreciation. Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period. Different companies may use different types of depreciation methods especially those in different industries.

120000 in the second year the output may be 50000 ton. N life of property in years. In addition to straight line depreciation there are also other methods of calculating depreciation Depreciation Methods The most common types of.

Various Depreciation Methods. Other Methods of Depreciation. Cost of the asset-residual value nr of years an asset.

The depreciation to be written off will be. Same depreciation is charged over the entire useful life. It is the simplest method of depreciation.

Methods of Calculating Depreciation. Where C original cost. Depreciation is an integral component of accounting.

S scrape value. Learn how to calculate depreciation here.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Methods Of Computing Depreciation

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation Expense Get Business Strategy

Methods To Calculate Property Depreciation Building Costing And Estimation Civil Engineering Projects

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

What Is Depreciation Definition Methods Formula To Calculate Depreciation

What Is Depreciation Types Examples Quiz Accounting Capital

Deprecition Ppt Video Online Download

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Check Formula Factors Types India Dictionary

Depreciation Methods 4 Types Of Depreciation You Must Know

What Is Depreciation Definition Objectives And Methods Business Jargons

Comments

Post a Comment